Pass Book of Ms Jane shows an overdraft of 50000. Timing differences items not recorded in the cash book payments in Another timing difference may also occur when the bank has received a direct payment from a customer of the business. bank reconciliation book side.

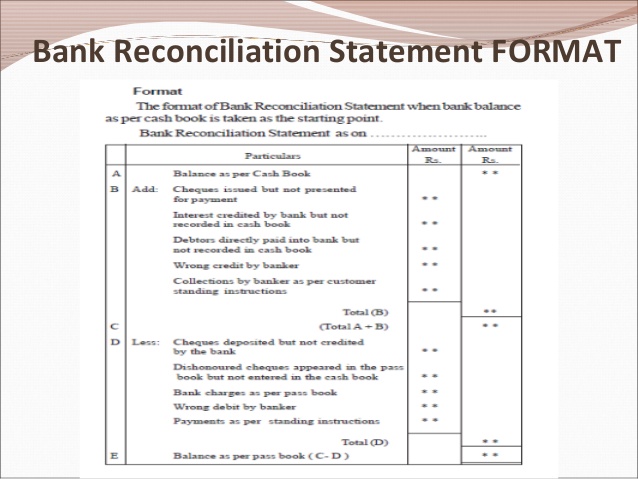

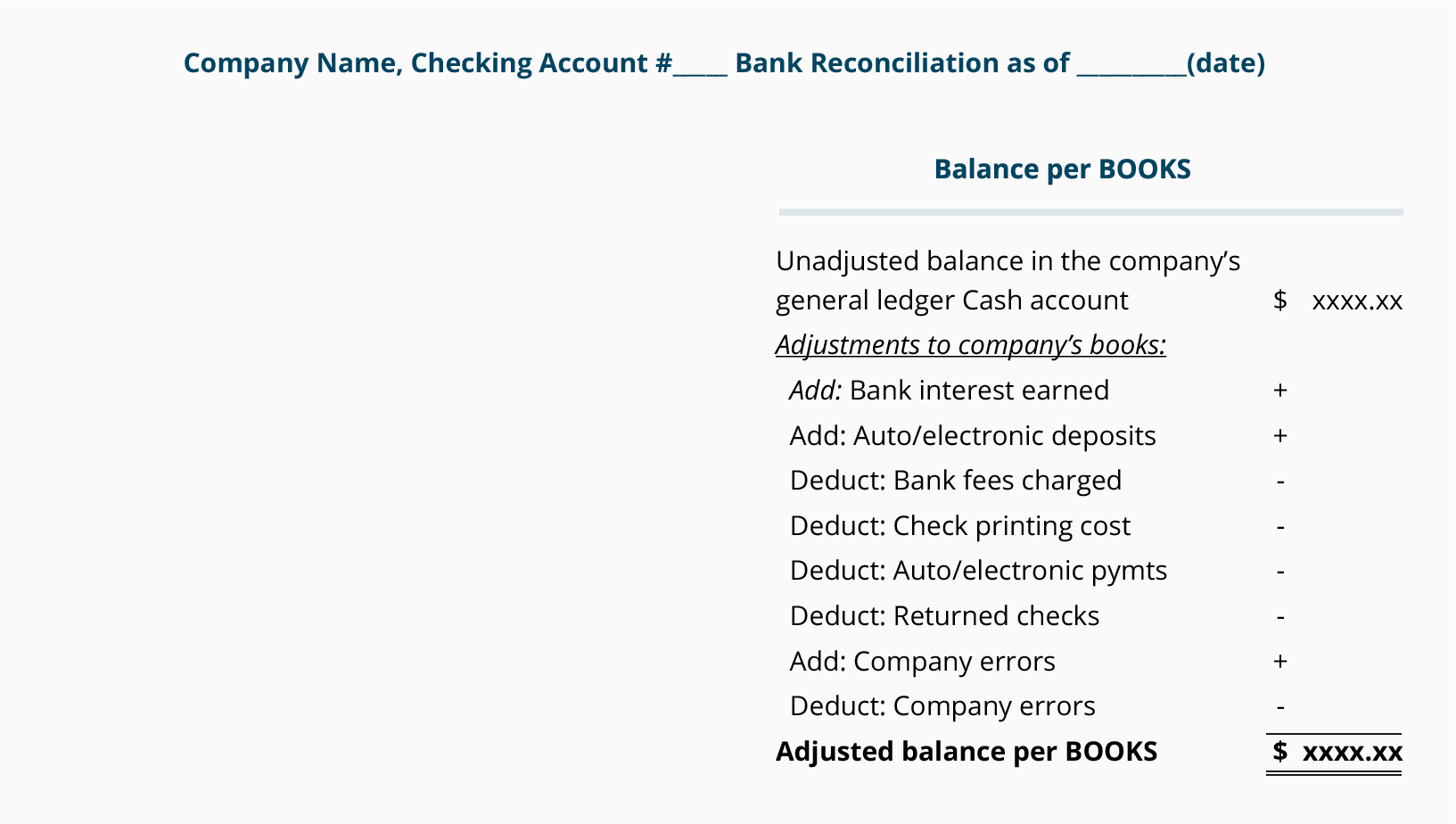

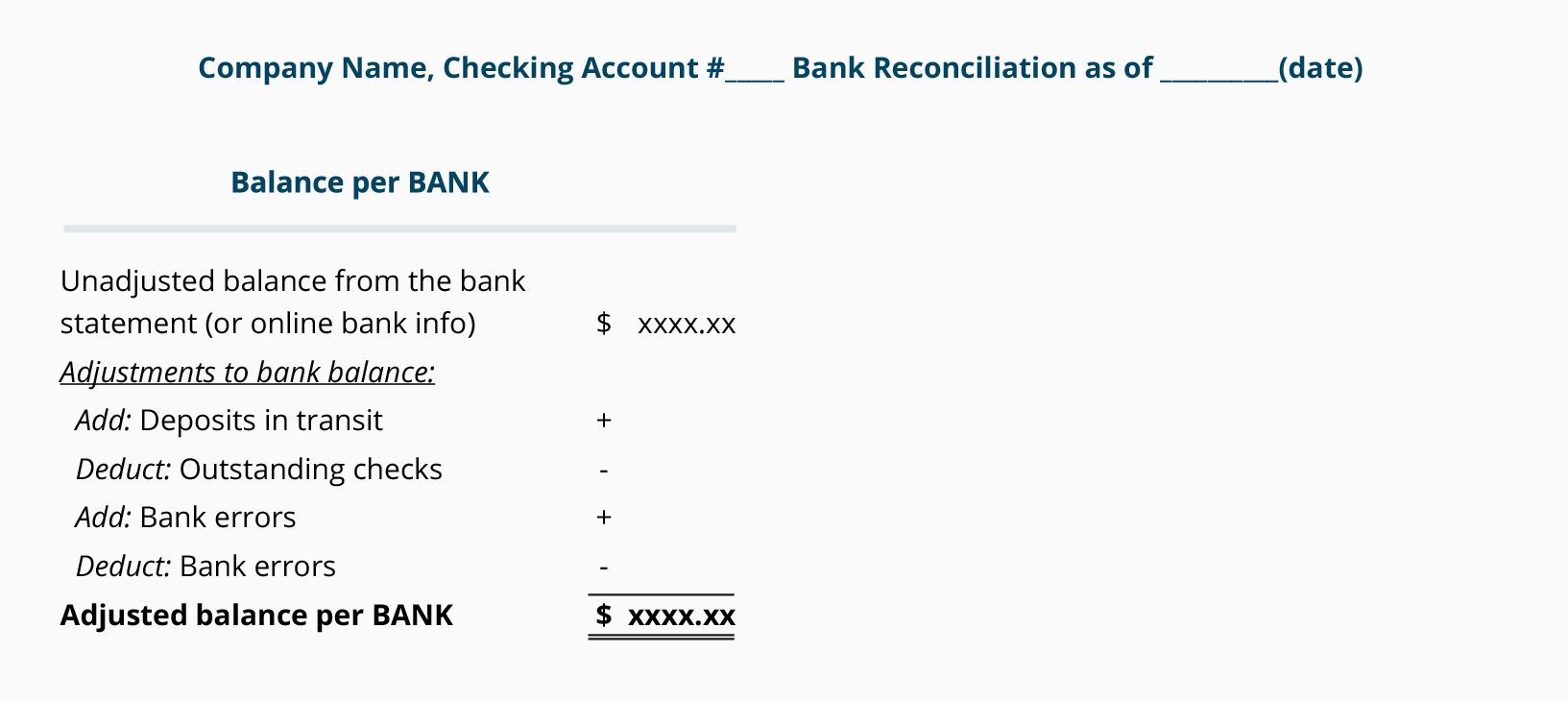

Bank Reconciliation Book Side, There are two parts to a bank reconciliation the book company side and the bank side. BANK RECONCILIATION STATEMENT To reconcile means to reason or nd out the dierence between two and eliminating that dierence. Watch a Demo of BlackLine Account Reconciliations.

Bank Reconciliation Statement Example Accounting Corner From accountingcorner.org

Bank Reconciliation Statement Example Accounting Corner From accountingcorner.org

Cash book bank columns bank reconciliation statement bank statement. Payment side bank column of Cash Book was undercast by 500. ProfAlldredge For best viewing switch t.

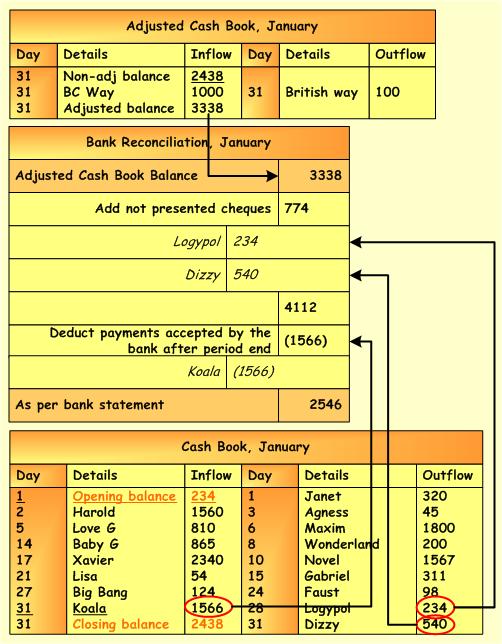

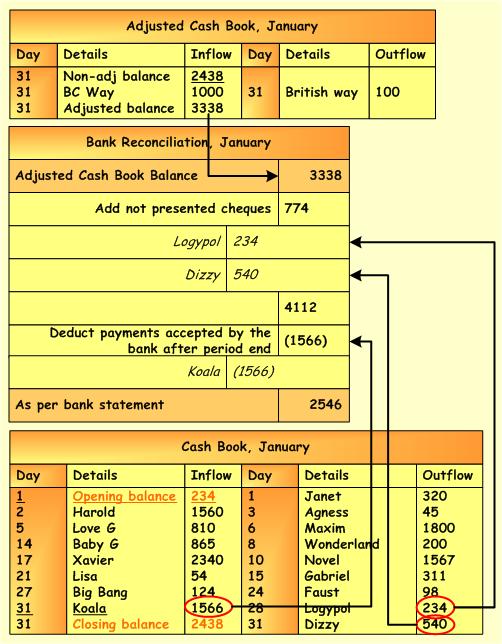

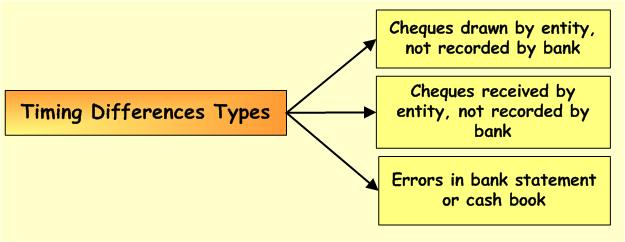

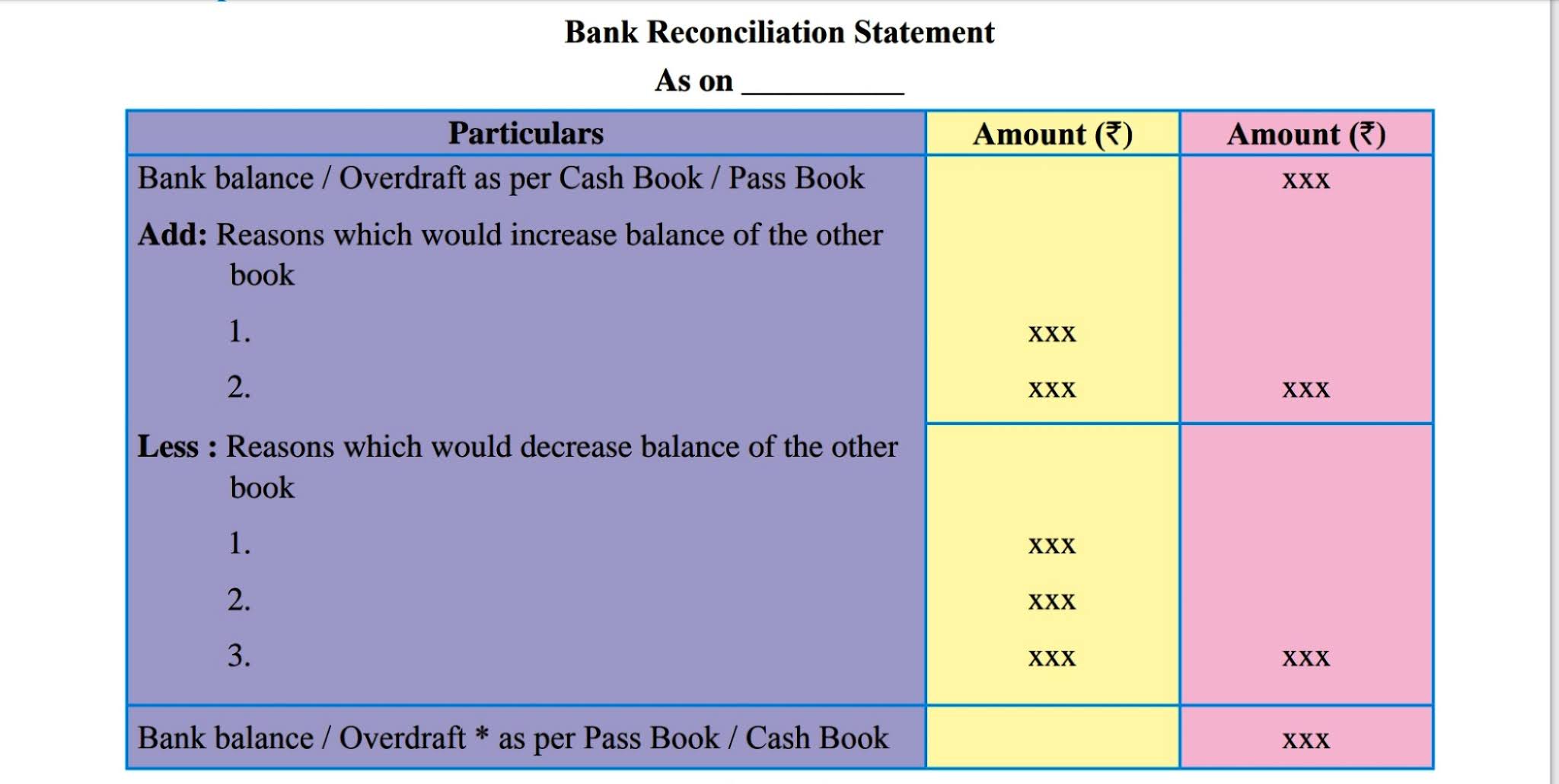

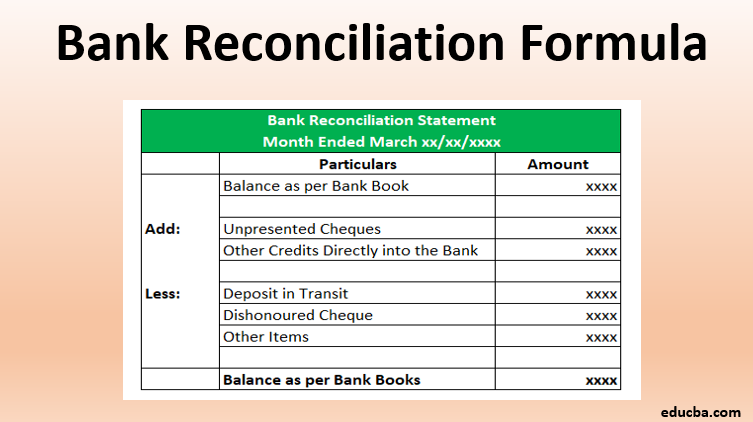

Bank Reconciliation Statement is a statement prepared periodically with a view to enlist the reasons for difference between the balances as per the bank column of the cashbook and pass bookbank statement on any given date.

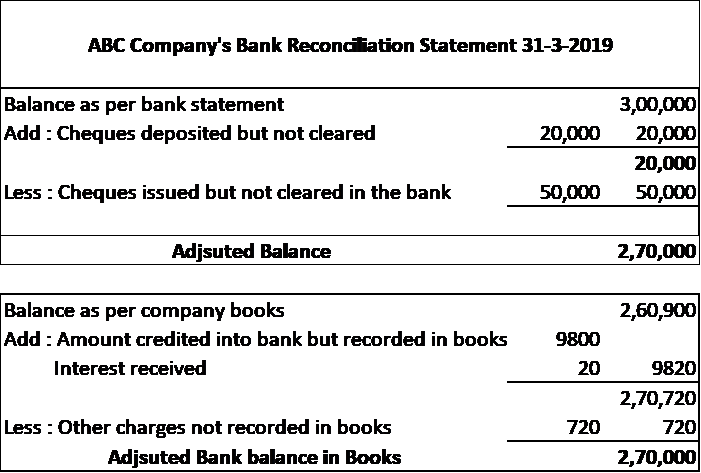

20000 and 25000 but presented on 5th January 2019. Whenever we deposit or withdraws money from banks it is always recorded at two places-1. Download the Free Template. What are we looking for. To move book transactions to the bank side follow these steps. You can do this by holding down the control CTRL key and left.

Another Article :

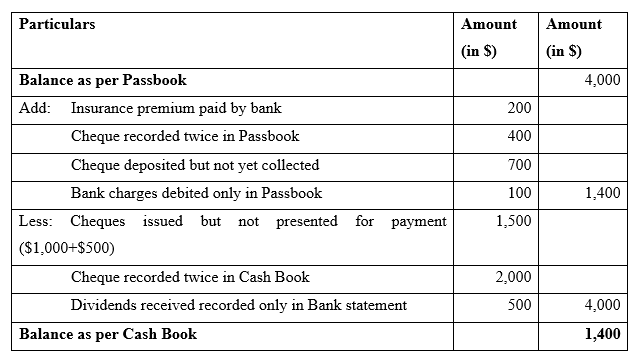

There are two parts to a bank reconciliation the book company side and the bank side. In the bank books the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. Bank Reconciliation Statement Debit and Credit Balance Balance as per Cash Book means the balance as per the Bank column of the Cash Book which is maintained by the trader or Banks client. The cash book shows a balance of Rs 33000 whereas the pass book shows a balance of Rs 39930. Bank column of the cash book. The Accounting Onion Bank Reconciliation Statement.

Bank Reconciliation Statement is a statement prepared periodically with a view to enlist the reasons for difference between the balances as per the bank column of the cashbook and pass bookbank statement on any given date. A bank reconciliation is the process of matching the balances in an entitys accounting records for a cash account to the corresponding information on a bank statement. In the bank books the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. If one looks at the debit side of the cash book and the deposits column of the pass book and checks item by item one will find that the following cheques deposited with the bank were not credited by the bank till 31st January. What are we looking for. What Is Bank Reconciliation Brs How To Prepare It.

Bank Reconciliation Statement. This video will explain how to complete a bank reconciliation on the book side. In this instance the bank will. It may happen that neither cash book balance nor pass book balance is correct because some receipts payments though recorded in cash book may be missing from pass book and similarly some receipts payments though recorded in the pass book may be missing from cash book. Examples of Cash Book. Bank Reconciliation Accounting Play Accounting Education Accounting Basics Accounting Books.

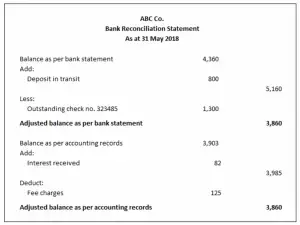

In this instance the bank will. Preparing Bank Reconciliation Statement. Prepare bank reconciliation statement. ProfAlldredge For best viewing switch t. From the following particulars prepare a Bank Reconciliation Statement on 31 st October XXXX. Bank Reconciliation Statement Example Accounting Corner.

Examples of Journal Entries for Bank Reconciliation. BANK RECONCILIATION STATEMENT To reconcile means to reason or nd out the dierence between two and eliminating that dierence. Here is a list of the most common items youll encounter when doing a bank reconciliation. Examples of Cash Book. A bank reconciliation is the process of matching the balances in an entitys accounting records for a cash account to the corresponding information on a bank statement. Bank Reconciliation.

Download the Free Template. Highlight all transactions that you wish to change. In the bank books the deposits are recorded on the credit side while the withdrawals are recorded on the debit side. Identify the bank balance to be reported in the final accounts. Ad Automate Standardise the Reconciliation Process to Produce Accurate Financial Statements. Cash Bank Reconciliations Accounting In Focus.

Sometimes these balances do not match. From the following particulars prepare Bank Reconciliation statement for Ms XYZ and company as at 31st December 2018. 20000 and 25000 but presented on 5th January 2019. Cheques issued of Rs. This topic can be found in chap. What Is Bank Reconciliation Accounting Corner.

Examples of Cash Book. Notice the following items in the condensed bank reconciliation format. 143 CASH BOOK In business most of the transactions relate to receipt of cash payments of cash sale of goods and purchase of goods. Bank statement pass book. It will also walk through a practice problem. Bank Reconciliation Instructions Reconciliation Account Reconciliation Bookkeeping And Accounting.

A bank reconciliation is the process of matching the balances in an entitys accounting records for a cash account to the corresponding information on a bank statement. Correct cash book errors or omissions. To move book transactions to the bank side follow these steps. Bank Reconciliation Statement Debit and Credit Balance Balance as per Cash Book means the balance as per the Bank column of the Cash Book which is maintained by the trader or Banks client. Examples of Cash Book. Bank Reconciliation Statement Meaning Need Format Preparation And Its Procedure Accounts And Quotes.

From Cash Book and Pass Book. Download the Free Template. Upon completion of this chapter you will be able to. The business needs to identify the reasons for the discrepancy and reconcile the differences. Payment side bank column of Cash Book was undercast by 500. Bank Reconciliation Services Simple Accounting.

When the reconciliation is completed both balances should match. Ad Automate Standardise the Reconciliation Process to Produce Accurate Financial Statements. A bank reconciliation is the process of matching the balances in an entitys accounting records for a cash account to the corresponding information on a bank statement. Identify the main differences between the cash book and the bank statement. Interest on overdraft charged by the bank was 1500. Adjustment In Bank Reconciliation Accountinguide.

Bank statement pass book. These are the items that appear on the bank statement but are not yet recorded in the companys general ledger accounts. The bank sends the account statement to its customers every month or at regular intervals. From Cash Book and Pass Book. Watch a Demo of BlackLine Account Reconciliations. Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach.

There are a number of items that can cause differences between your book and bank balances. There are a number of items that can cause differences between your book and bank balances. Interest on overdraft charged by the bank was 1500. Prepare bank reconciliation statement. Bank Reconciliation Formula Example 1. Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach.

These are the items that appear on the bank statement but are not yet recorded in the companys general ledger accounts. Prepare bank reconciliation statement. It may happen that neither cash book balance nor pass book balance is correct because some receipts payments though recorded in cash book may be missing from pass book and similarly some receipts payments though recorded in the pass book may be missing from cash book. Need of preparing Bank Reconciliation Statement A Bank Reconciliation Statement is a statement reconciling the balance as. From the following particulars prepare a Bank Reconciliation Statement on 31 st October XXXX. Bank Reconciliation Formula Examples With Excel Template.

There are a number of items that can cause differences between your book and bank balances. To move book transactions to the bank side follow these steps. Upon completion of this chapter you will be able to. If one looks at the debit side of the cash book and the deposits column of the pass book and checks item by item one will find that the following cheques deposited with the bank were not credited by the bank till 31st January. Ad Automate Standardise the Reconciliation Process to Produce Accurate Financial Statements. Cash Bank Reconciliations Accounting In Focus.