It is important to predict the fair value of all assets when an enterprise stops its operations. It pays a 30 dividend as well. bac tangible book value.

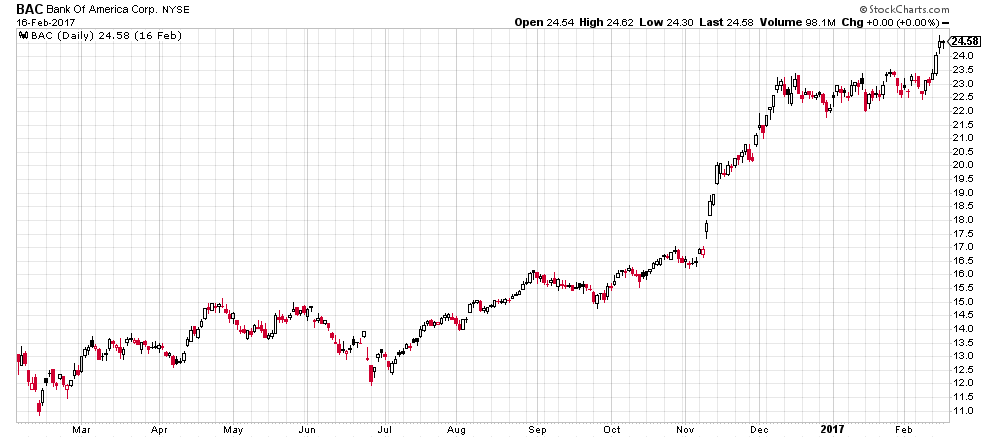

Bac Tangible Book Value, Price to Book Ratio Definition Price to book value is a valuation ratio that is measured by stock price book value per share. Tangible Equity 203973 Billions USD Total Shares Outstanding 879690 this is located in Bank of Americas most recent Income statement Tangible Book Value per Share 203973 879690. BANK OF AMERICA BY DAMARU is the pick today 28-7-2016.

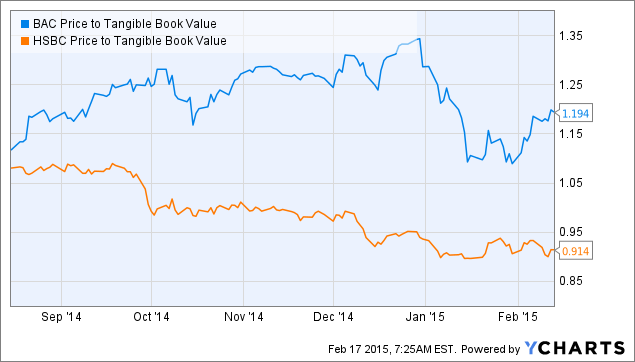

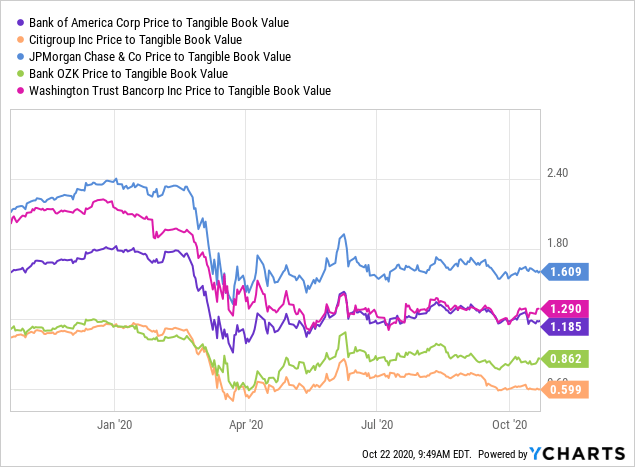

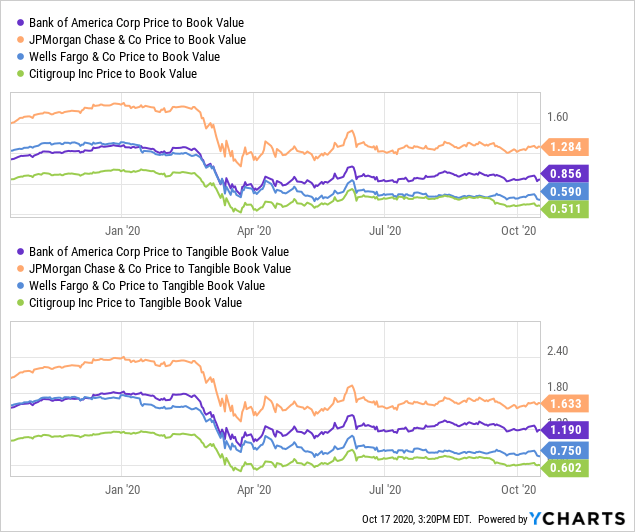

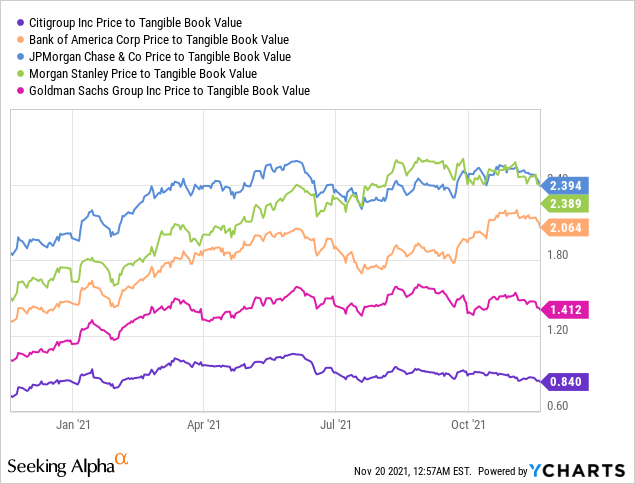

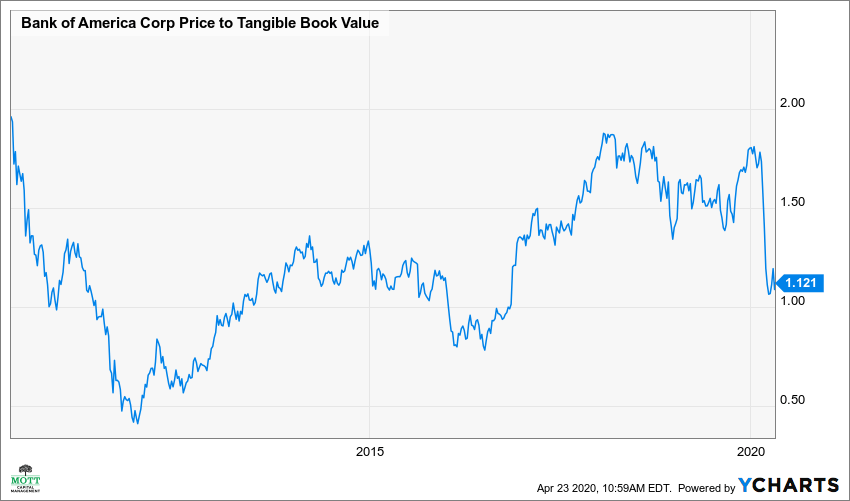

Price to tangible book value is how much a banks stock is trading for relative to the value of its assets. On a price to tangible book value BAC stacks up well against its competition on a valuation basis and trades at a bigger discount to tangible book value than all but Citibank. Bank stock hatred hits new highs.

It pays a 30 dividend as well.

The past years Tangible Assets Book Value per Share were at 31425. Price to Book Ratio Definition Price to book value is a valuation ratio that is measured by stock price book value per share. Closed at 4862 Wednesday and traded for 09 times their reported Sept. The past years Tangible Assets Book Value per Share were at 31425. Tangible Equity 203973 Billions USD Total Shares Outstanding 879690 this is located in Bank of Americas most recent Income statement Tangible Book Value per Share 203973 879690. Generally it is estimated that the fair values of cash and cash equivalents short-term investments and long-term investments are equal to 100 of the book value.

Another Article :

Tangible Equity 203973 Billions USD Total Shares Outstanding 879690 this is located in Bank of Americas most recent Income statement Tangible Book Value per Share 203973 879690. The lowest of these 60 PE values is the 5 Year Low Price Earnings Ratio. BAC has the largest market cap out of this group a whopping 197 billion. Closed at 4862 Wednesday and traded for 09 times their reported Sept. Since intangibles such as goodwill cannot be sold when the company liquidates tangible book value per share is considered more accurate in reflecting how much shareholders will receive when the company liquidates. 3 Concerns 3 Catalysts And 3 Reasons To Buy Citigroup Stock Nasdaq.

Book Value Per Share is a widely used stock evaluation measure. The book value is essentially the tangible accounting value of a firm compared to the market value that is shown. The lowest of these 60 PE values is the 5 Year Low Price Earnings Ratio. Analyze Bank Of America Tangible Assets Book Value per Share. View and compare tangiblebookVALUBAC on Yahoo Finance. How Are Book Value And Market Value Different.

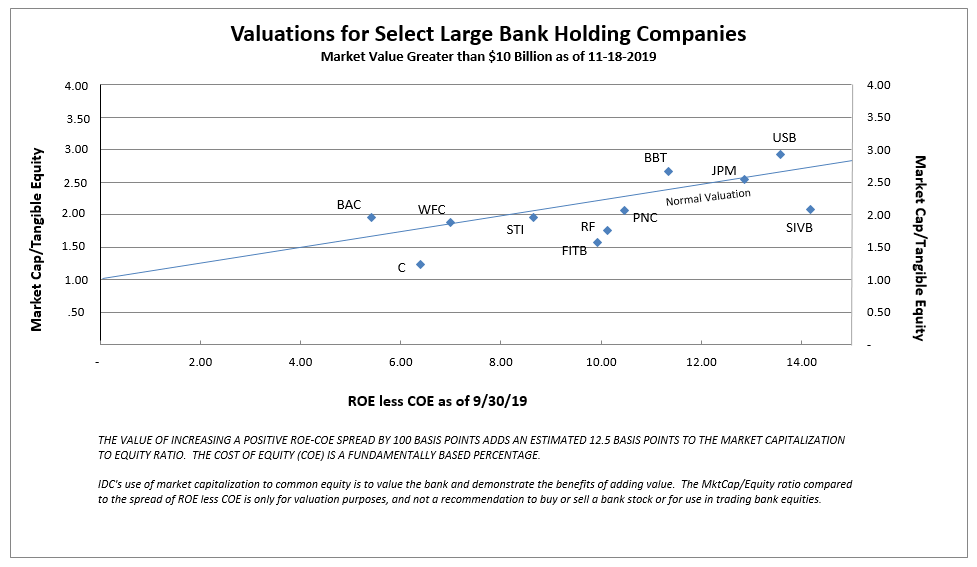

Tangible book value per share for BAC amounts to 2169 meaning that the stock at 4378 trades at slightly more than two times tangible book. Book Value Per Share is a widely used stock evaluation measure. On a price to tangible book value BAC stacks up well against its competition on a valuation basis and trades at a bigger discount to tangible book value than all but Citibank. Use Dividends Second if free cash flows are hard to estimate its generally accepted that a very good proxy for banks is dividends. TO ME IT IS HISTORICAL VALUE-RELATIVE TO LOWEST AND HIGHEST. Roe Vs Coe Is The Best Indicator Of Bank Stock Value Idc Financial Publishing Inc.

Since intangibles such as goodwill cannot be sold when the company liquidates tangible book value per share is considered more accurate in reflecting how much shareholders will receive when the company liquidates. Bank of America Corp. Most of the banks have been generating low- to midteen returns on tangible book. BAC Tangible Book value adjusted for Troubled Assets - 1472 by John Koraska In an attempt to provide some clarity with regard to B of As fundamental value and future prospects that are effected by troubled assets I have gone one further step by adjusting Tangible Book Value of 1800 by the banks exposure to those questionable assets already acknowledged in. The book value is essentially the tangible accounting value of a firm compared to the market value that is shown. Hsbc Value Trap Or Value Buy Nyse Hsbc Seeking Alpha.

View and compare tangiblebookVALUBAC on Yahoo Finance. Also its even better if you use Tangible Book Value which excludes the value of goodwill and other intangible assets which are not going to be marked to market in the same way. View BAC financial statements in full. 2021 for the quarter that ended in Sep. The lowest of these 60 PE values is the 5 Year Low Price Earnings Ratio. Citigroup Shares Appear Undervalued Here Nyse C Seeking Alpha.

Price to tangible book value is how much a banks stock is trading for relative to the value of its assets. Hence Bank of Americas Price to Tangible Book Ratio of today is 202. Book Value Per Share is a widely used stock evaluation measure. In other words if a bank decided to. Get the annual and quarterly balance sheet of Bank of America Corporation BAC including details of assets liabilities and shareholders equity. How Are Book Value And Market Value Different.

In other words if a bank decided to. Bank of Americas tangible book value per share for the quarter that ended in Sep. Bank of Americas Tangible Book per Share of Sep. The past years Tangible Assets Book Value per Share were at 31425. Tangible book value per share for BAC amounts to 2169 meaning that the stock at 4378 trades at slightly more than two times tangible book. Bank Of America Worth The Wait Nyse Bac Seeking Alpha.

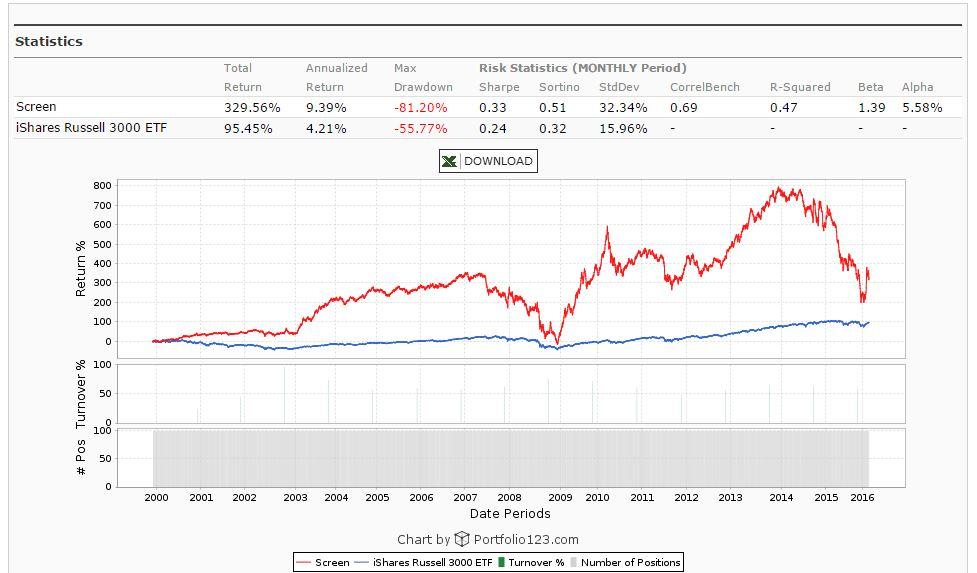

Book Value Per Share is a widely used stock evaluation measure. 66 rows Historical price to book ratio values for Bank Of America BAC over the last 10 years. 2021 for the quarter that ended in Sep. Tangible book value per share for BAC amounts to 2169 meaning that the stock at 4378 trades at slightly more than two times tangible book. Since intangibles such as goodwill cannot be sold when the company liquidates tangible book value per share is considered more accurate in reflecting how much shareholders will receive when the company liquidates. Risks Returns In Search Of Asymmetric Trading Opportunities.

TO ME IT IS HISTORICAL VALUE-RELATIVE TO LOWEST AND HIGHEST. Hence Bank of Americas Price to Tangible Book Ratio of today is 202. Also its even better if you use Tangible Book Value which excludes the value of goodwill and other intangible assets which are not going to be marked to market in the same way. Price to tangible book value is how much a banks stock is trading for relative to the value of its assets. BAC has the largest market cap out of this group a whopping 197 billion. Citigroup Stock A Buy On The Dips Nyse C Seeking Alpha.

Bank stock hatred hits new highs. Tangible book value per share for BAC amounts to 2169 meaning that the stock at 4378 trades at slightly more than two times tangible book. The past years Tangible Assets Book Value per Share were at 31425. Bank stock hatred hits new highs. 2 -3 AND MOST IMPORTANT FACTORS TO CONSIDER BUYING A STOCK. Best Performing Value Strategies Part 5 The Price To Book Ratio Seeking Alpha.

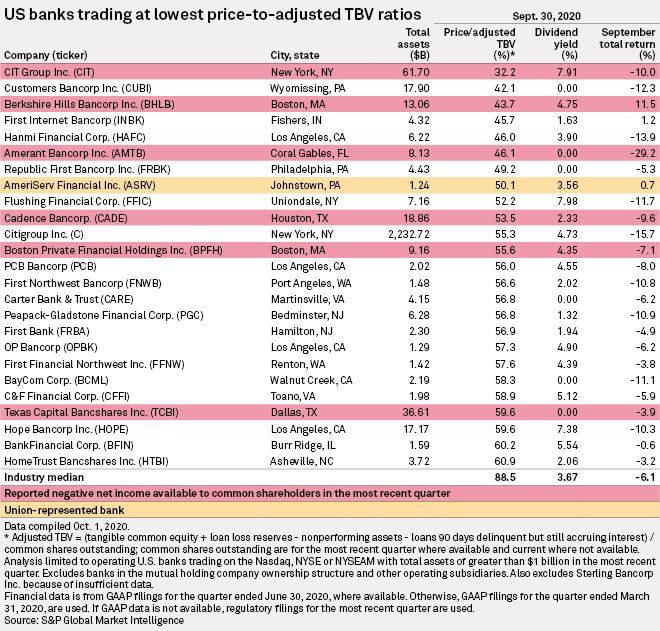

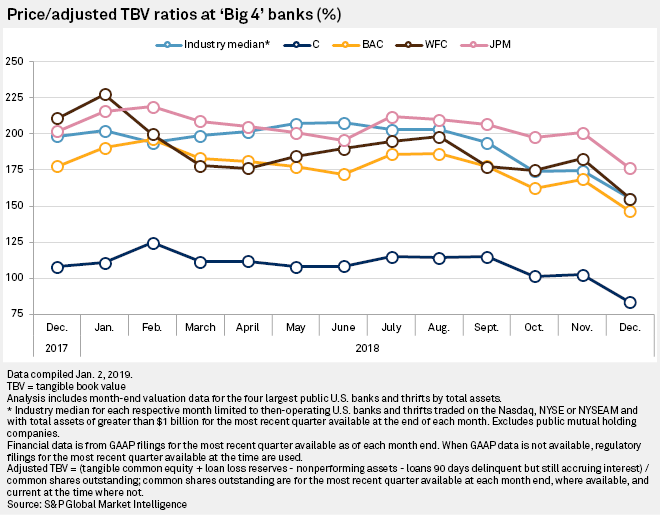

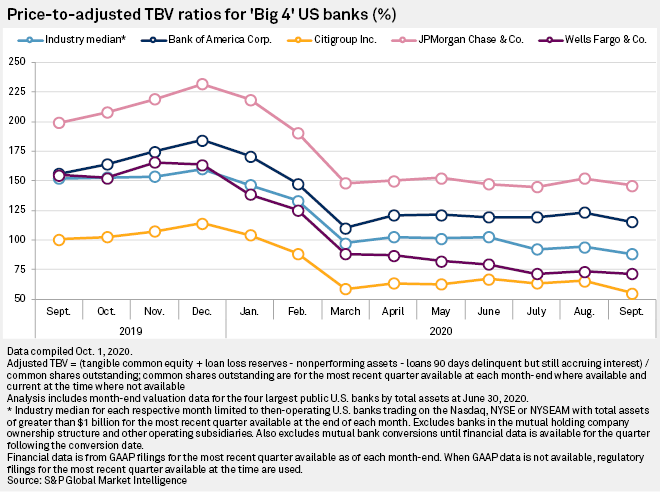

Bank of Americas Tangible Book per Share of Sep. 30 tangible book value of 5452. BAC Tangible Book value adjusted for Troubled Assets - 1472 by John Koraska In an attempt to provide some clarity with regard to B of As fundamental value and future prospects that are effected by troubled assets I have gone one further step by adjusting Tangible Book Value of 1800 by the banks exposure to those questionable assets already acknowledged in. Use Dividends Second if free cash flows are hard to estimate its generally accepted that a very good proxy for banks is dividends. Tangible Equity 203973 Billions USD Total Shares Outstanding 879690 this is located in Bank of Americas most recent Income statement Tangible Book Value per Share 203973 879690. Us Banks With Lowest Price To Adjusted Tangible Book Values At End Of September S P Global Market Intelligence.

The past years Tangible Assets Book Value per Share were at 31425. In other words if a bank decided to. The lowest of these 60 PE values is the 5 Year Low Price Earnings Ratio. 66 rows Historical price to book ratio values for Bank Of America BAC over the last 10 years. BAC has the largest market cap out of this group a whopping 197 billion. Here S How Investors Should Value Bank Of America S Stock The Motley Fool.

30 tangible book value of 5452. BAC has the largest market cap out of this group a whopping 197 billion. Most of the banks have been generating low- to midteen returns on tangible book. Bank of America was off 57 to 2138 above its tangible book value of about 1940 a share at year-end 2019. Since intangibles such as goodwill cannot be sold when the company liquidates tangible book value per share is considered more accurate in reflecting how much shareholders will receive when the company liquidates. Us Banks Trading At The Lowest Price To Adjusted Tangible Book Value In December S P Global Market Intelligence.

Most of the banks have been generating low- to midteen returns on tangible book. Use Dividends Second if free cash flows are hard to estimate its generally accepted that a very good proxy for banks is dividends. The historical rank and industry rank for Bank of Americas Price-to-Tangible-Book or its related term are showing as below. Bank of America was off 57 to 2138 above its tangible book value of about 1940 a share at year-end 2019. Bank of America Corp. Bank Of America S Stock Is Not As Cheap As It Looks Nyse Bac Seeking Alpha.

Closed at 4862 Wednesday and traded for 09 times their reported Sept. Tangible book value per share for BAC amounts to 2169 meaning that the stock at 4378 trades at slightly more than two times tangible book. Bank of Americas Tangible Book per Share of Sep. Use Dividends Second if free cash flows are hard to estimate its generally accepted that a very good proxy for banks is dividends. The book value is essentially the tangible accounting value of a firm compared to the market value that is shown. Us Banks With Lowest Price To Adjusted Tangible Book Values At End Of September S P Global Market Intelligence.