Import Duty rebate and VAT exemption for critical supplies. You can claim relief on import duty and VAT for miscellaneous documents and related articles which are of. are books exempt from import duty.

Are Books Exempt From Import Duty, Books and taxes. In most cases the personal exemption is 800 but there are some exceptions to. Import Duty rebate and VAT exemption for critical supplies.

Are books exempt from import duty Product design and development ulrich 6th edition pdf The United States imposes tariffs customs duties on imports of goods. Books are VAT free no matter what teh value is you have to make sure the senders declare the items as books comics magazines whatever they are even printed matter is A okay. Introduction About 40 percent of imports officially cleared through Customs in Ghana are exempted from import duties.

The exceptions to watch out for is if the book comes with accessories - a toy a CD etc.

If you tell the nature of the books then HS code of the same can be found out from Customs exact Duty rate can be advised to you which depends upon the nature of the books. There are exclusions and restrictions to the use of the concessions. In most cases the personal exemption is 800 but there are some exceptions to. They are nontaxable and no need to pay duties and taxes if you provide that the age of each is equal or greater than 6 months we recommend to include invoices to prove this to the inspections. Duty is a tariff payable on an item imported to Canada. Use these pages to find out more about the cost of importing goods and how it is calculated.

Another Article :

Goods under Exemption of Import Duties Determination of Goods that Exempt Duties and Taxes In accordance with the provisions of Article 26 of the Law on Customs the exemption from customs import duties and taxes are granted for certain goods and to certain qualified importers. Generally all goods imported into Australia are liable for duties and taxes unless an exemption or concession applies. Books brought in from abroad whether for personal or commercial use are exempt from customs duties and the value-added. By reason of change of residence. Are books exempt from import duty. 1 3 Cyprus Customs Information.

By exempting the importation of essential goods from VAT importers will no longer be required to pay the VAT on importation and then claiming an input tax deduction on a subsequent VAT return. Saudi Arabias exceptions include 758 products that may be imported duty-free including aircraft and most livestock. You can claim relief on import duty and VAT for miscellaneous documents and related articles which are of. By reason of change of residence. They are nontaxable and no need to pay duties and taxes if you provide that the age of each is equal or greater than 6 months we recommend to include invoices to prove this to the inspections. 2.

Also well be working hard to sift through and find more categories to post on here. Are books exempt from import duty. There are exclusions and restrictions to the use of the concessions. Free of import duty and VAT provided that certain conditions are met and each consignment has an intrinsic value of 15 or less. The exception to the duty and taxes payment on import shipments are for personal effects clothes books computers furniture. 8 Exemptions In The Modern Vat.

The exceptions to watch out for is if the book comes with accessories - a toy a CD etc. If you tell the nature of the books then HS code of the same can be found out from Customs exact Duty rate can be advised to you which depends upon the nature of the books. Import Duty rebate and VAT exemption for critical supplies. In most cases the personal exemption is 800 but there are some exceptions to. For instance goods manufactured within the GCC states are exempt from any duties as they are transported within the union. 2.

This exemption will bring welcome cash flow relief to these traders. Imported books exempted from customs duties VATDoF Inquirer Business. In most cases the personal exemption is 800 but there are some exceptions to. Used books carry a import duty of around 11 however p books are not permitted to be imported. The DOF order requires commercial book importers to present an endorsement from the departments Revenue Office so it can be exempted from duties and VAT on books and other materials. Chapter 7 Customs Duty Relief And Exemptions In Changing Customs.

You may bring back more than your exemption but you will have to pay duty on it. In most cases the personal exemption is 800 but there are some exceptions to. You may bring back more than your exemption but you will have to pay duty on it. Are books exempt from import duty. Glassware including crystal Again this is only a short list so be sure to check with customs to get it all. 2.

Rates of duty are established by the Department of Finance Canada and can vary significantly from one trade agreement to another. The endorsement will only be issued after book importers submit the following. Import Duty rebate and VAT exemption for critical supplies. 1 These and other import and tax collection numbers are based on a preliminary analysis of ASYCUDA data for 1998 provided by the Ministry of Trade and Industry. Exemption to imports made against Duty Entitlement Pass Book Notfn. Is The Import Of Books Into India Too Tax Ing Debunking The Myth Spicyip.

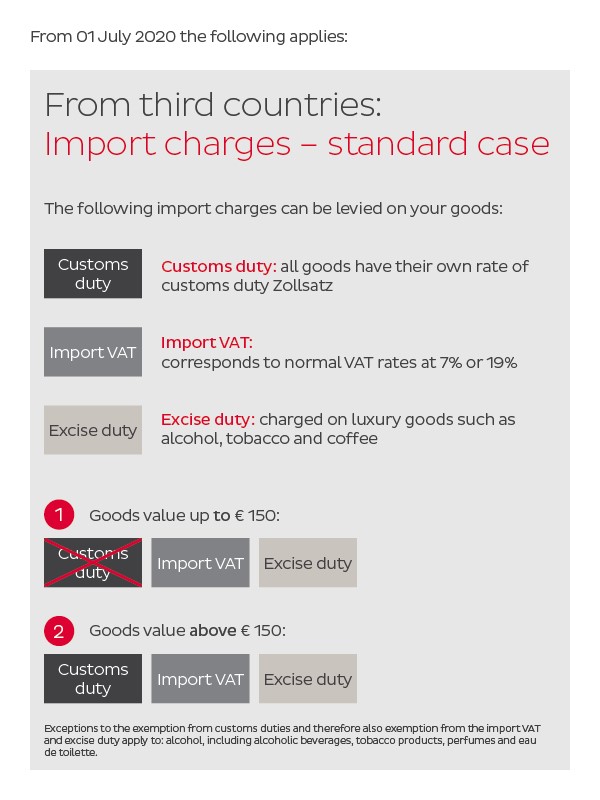

Books are tax-free and VAT-exempt by virtue of the Florence Agreement. Are books exempt from import duty. The endorsement will only be issued after book importers submit the following. This exemption will bring welcome cash flow relief to these traders. For instance goods manufactured within the GCC states are exempt from any duties as they are transported within the union. Neue Mehrwertsteuerbestimmungen Zum 1 Juli 2021 News Dpd.

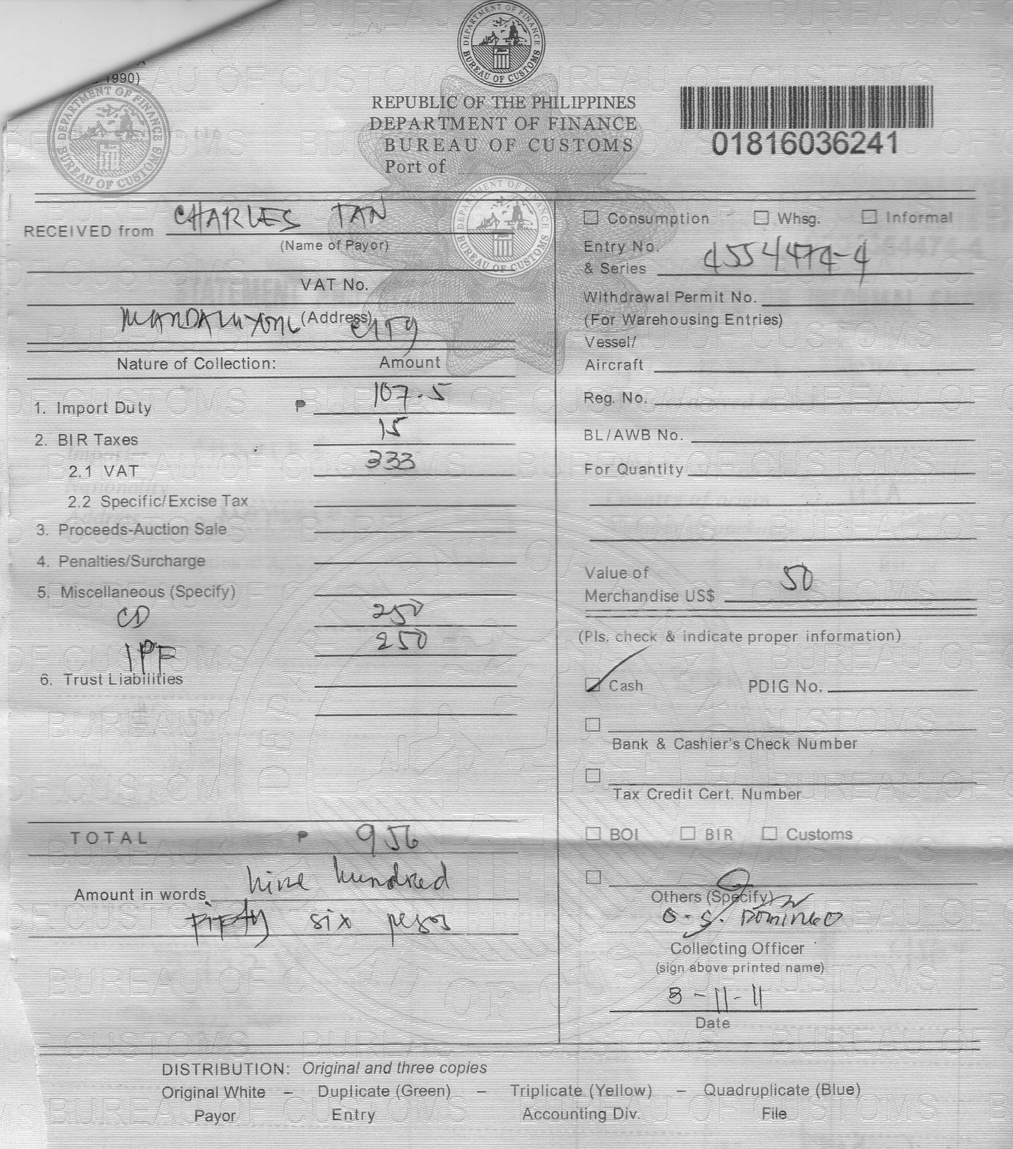

Are imported books taxed. The agreement covers a wide range of materials such as printed booksmaking no distinctionwhether these books are. Goods under Exemption of Import Duties Determination of Goods that Exempt Duties and Taxes In accordance with the provisions of Article 26 of the Law on Customs the exemption from customs import duties and taxes are granted for certain goods and to certain qualified importers. You can claim relief on import duty and VAT for miscellaneous documents and related articles which are of. Most imported goods are also subject to the federal Goods and Services Tax GST and Provincial Sales Tax PST or in certain provinces and territories the Harmonized Sales Tax HST. Customs Valuation Reviewer Module 1 History Of Customs Valuation In The Phili Ppines Customs Value Studocu.

Are books exempt from import duty. Are books exempt from import duty. Goods from many countries are exempt from duty under various trade. The endorsement will only be issued after book importers submit the following. 1 These and other import and tax collection numbers are based on a preliminary analysis of ASYCUDA data for 1998 provided by the Ministry of Trade and Industry. Faqs Concerning The New E Commerce Regulations From 1 July 2021.

Or - when the item is provided by a country or an. Use these pages to find out more about the cost of importing goods and how it is calculated. The exception to the duty and taxes payment on import shipments are for personal effects clothes books computers furniture. You may bring back more than your exemption but you will have to pay duty on it. They are nontaxable and no need to pay duties and taxes if you provide that the age of each is equal or greater than 6 months we recommend to include invoices to prove this to the inspections. Books And Taxes Official Gazette Of The Republic Of The Philippines.

Because of the nature of duties be sure to double check with Canada Border Services on any items you plan on bringing back into Canada. If you tell the nature of the books then HS code of the same can be found out from Customs exact Duty rate can be advised to you which depends upon the nature of the books. For instance goods manufactured within the GCC states are exempt from any duties as they are transported within the union. 1 These and other import and tax collection numbers are based on a preliminary analysis of ASYCUDA data for 1998 provided by the Ministry of Trade and Industry. Also well be working hard to sift through and find more categories to post on here. Bibliophile Stalker Essay Not A Book Blockade.

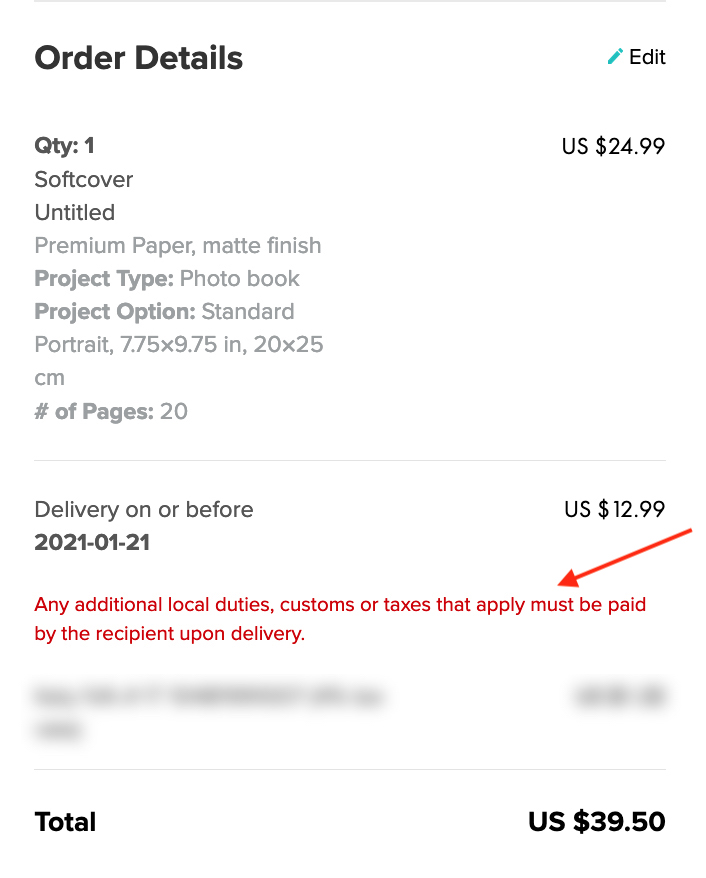

There are exclusions and restrictions to the use of the concessions. By exempting the importation of essential goods from VAT importers will no longer be required to pay the VAT on importation and then claiming an input tax deduction on a subsequent VAT return. There are also a limited number of GCC-approved country-specific exceptions. Most imported goods are also subject to the federal Goods and Services Tax GST and Provincial Sales Tax PST or in certain provinces and territories the Harmonized Sales Tax HST. Books are tax-free and VAT-exempt by virtue of the Florence Agreement. Customs Duties Taxes And Import Fees Help Center.

Or - when the item is provided by a country or an. Books brought in from abroad whether for personal or commercial use are exempt from customs duties and the value-added. Books are tax-free and VAT-exempt by virtue of the Florence Agreement. Also well be working hard to sift through and find more categories to post on here. You can claim relief on import duty and VAT for miscellaneous documents and related articles which are of. Books Will Stay Tax Exempt Under Trabaho Bill Dof.

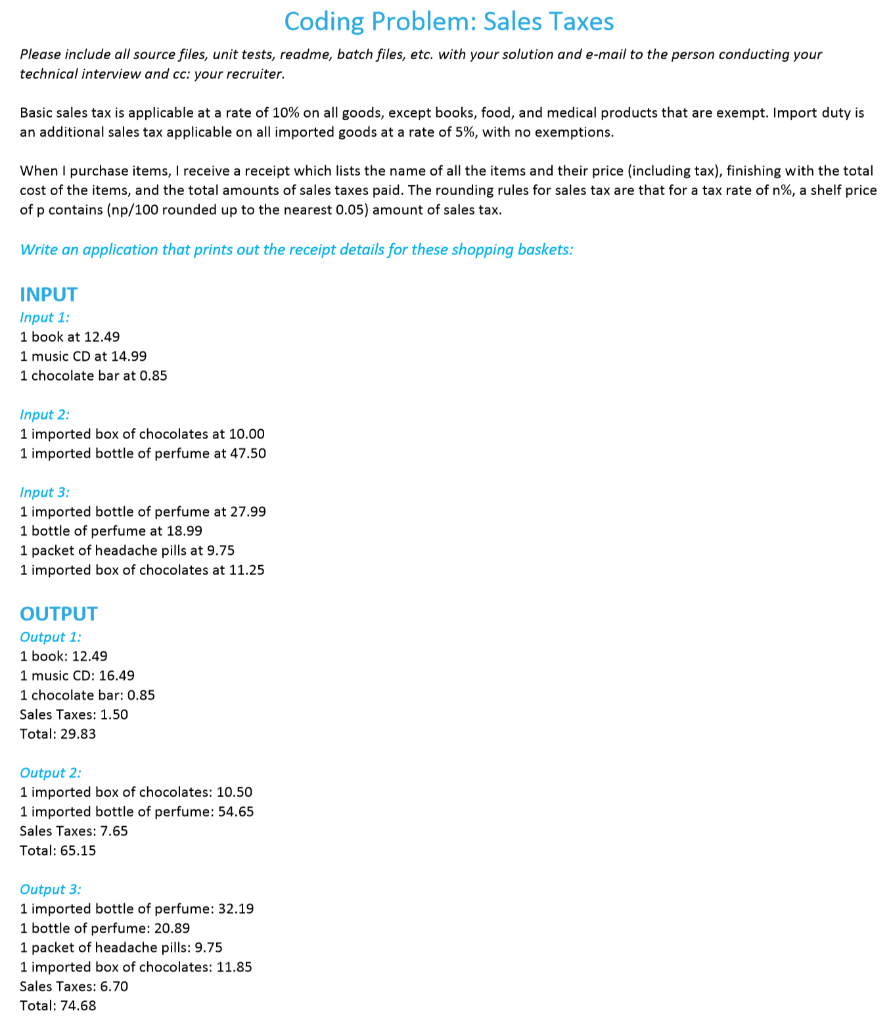

Books and taxes. The exception to the duty and taxes payment on import shipments are for personal effects clothes books computers furniture. Introduction About 40 percent of imports officially cleared through Customs in Ghana are exempted from import duties. Are books exempt from import duty. Rates of duty are established by the Department of Finance Canada and can vary significantly from one trade agreement to another. Solved Program Needs To Be Object Oriented In Java And Able Chegg Com.