Annamaria Lusardi Pierre-Carl Michaud and Olivia S. Annamaria Lusardi and Olivia S. annamaria lusardi books.

Annamaria Lusardi Books, We start with an overview of theoretical research which casts financial knowledge as a form of investment in human capital. Evidence and Implications Swiss Journal of Economics and Statistics 551 January 2019. As financial markets grow ever more complex and integrated households must make increasingly sophisticated and all-too-often irreversible economic decisions.

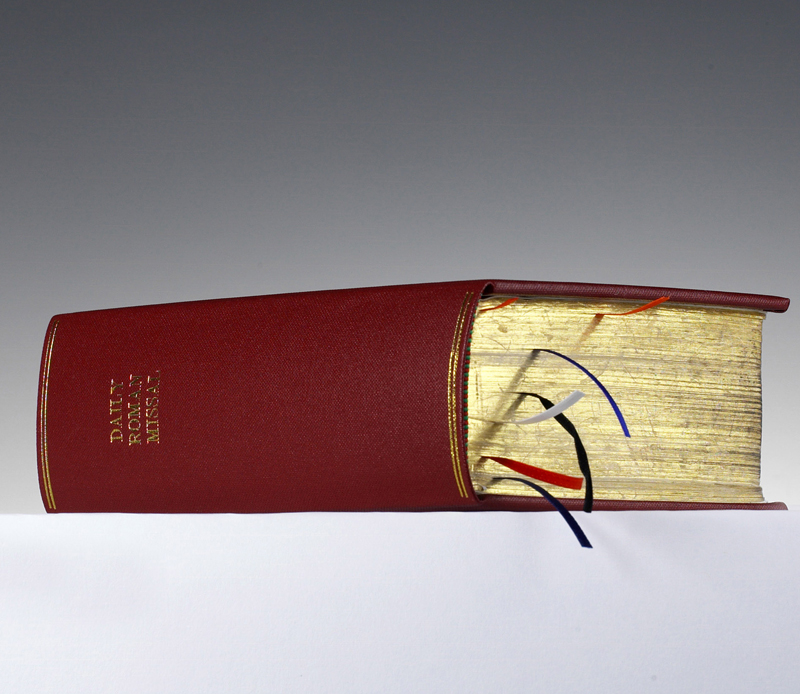

Remaking Retirement Debt In An Aging Economy Pension Research Council Series Mitchell Olivia Lusardi Annamaria 9780198867524 Amazon Com Books From amazon.com

Remaking Retirement Debt In An Aging Economy Pension Research Council Series Mitchell Olivia Lusardi Annamaria 9780198867524 Amazon Com Books From amazon.com

And Susan Hyatt Professor of Economics at Dartmouth College where she taught for twenty years. D91 ABSTRACT We analyze a national sample of Americans with respect to their debt literacy financial experiences and their judgments about the extent of their indebtedness. Book Google Scholar Lusardi A de Bassa Scheresberg C and Avery M.

Mitchell Oxford University Press Download PDF Financial Literacy and the Need for Financial Education.

George Washington University - Department of Accountancy University of Quebec at Montreal UQAM - Department of Economics and University of Pennsylvania - The Wharton School. Millennial mobile payment users. Annamaria Lusardi and Olivia S. As financial markets grow ever more complex and integrated households must make increasingly sophisticated and all-too-often. Book Google Scholar Lusardi A de Bassa Scheresberg C and Avery M. Previously she was the Joel Z.

Another Article :

Her interests focus on financial literacy and financial education. Evidence and Implications Swiss Journal of Economics and Statistics 551 January 2019. In fact the personal savings rate has been holding steady at zero for several years down from 8 percent in the mid-1980s. In 2004 the Big Three questions created by Professor Olivia Mitchell and me were first fielded in the US. Introduction Households hold very different amounts of. Annamaria Lusardi School Of Business The George Washington University.

National Financial Capability Study. Mitchell Oxford University Press Download PDF Financial Literacy and the Need for Financial Education. 05 Jan 2013 Last Revised. What explains this low level. Annamaria Lusardi and Olivia S. Awards Prizes Annamaria Lusardi.

Overcoming the Saving Slump explores the many challenges facing workers in the transition from a traditional defined benefit pension system to one. Google Scholar Lusardi. Annamaria Lusardi Pierre-Carl Michaud and Olivia S. Overcoming the Saving Slump explores the many challenges facing workers in the transition from a traditional defined benefit pension system to one. Alessie University of Groningen Department of Economics PO. Podcasts Annamaria Lusardi.

05 Jan 2013 Last Revised. Annamaria Lusardi and Olivia S. Box 800 9700 AV Groningen rjmalessierugnl. They have been used worldwide including in the US. We start with an overview of theoretical research which casts financial knowledge as a form of investment in human capital. Remaking Retirement Debt In An Aging Economy Pension Research Council Series Mitchell Olivia Lusardi Annamaria 9780198867524 Amazon Com Books.

And Susan Hyatt Professor of Economics at Dartmouth College. Overcoming the Saving Slump explores the many challenges facing workers in the transition from a traditional defined benefit pension system to one. Overcoming the Saving Slump explores the. Google Scholar Lusardi. Her interests focus on financial literacy and financial education. Videos Annamaria Lusardi.

05 Jan 2013 Last Revised. Mitchell mitchelowhartonupennedu is the International Foundation of Employee Benefit Plans Professor in the Department of Insurance and Risk Management the Wharton School at the University of Pennsylvania. The great majority of working Americans are unprepared to face the difficult task of planning for retirement. In fact the personal savings rate has been holding steady at zero for several years down from 8 percent in the mid-1980s. In June I had the pleasure of interviewing one of the worlds foremost financial literacy experts Dr Annamaria Lusardi. Annamaria Lusardi Home Facebook.

In June I had the pleasure of interviewing one of the worlds foremost financial literacy experts Dr Annamaria Lusardi. Annamaria Lusardi AnnamariaLusardidartmouthedu is the Joel Z. What explains this low level. In fact the personal savings rate has been holding steady at zero for several years down from 8 percent in the mid-1980s. Mitchell Many Baby Boomers are approaching retirement with perilously low levels of financial wealth and virtually no assets other than their homes Annamaria Lusardi and Olivia S. We Need People To Know The Abc Of Finance Facing Up To The Financial Literacy Crisis Financial Times.

Annamaria Lusardi and Olivia S. The great majority of working Americans are unprepared to face the difficult task of planning for retirement. Yakoboski and Dickemper 1997. Annamaria Lusardi Pierre-Carl Michaud and Olivia S. Annamaria Lusardi and Olivia S. Financial Literacy Wharton School Press.

In fact the personal savings rate has been holding steady at zero for several years down from 8 percent in the mid-1980s. 05 Jan 2013 Last Revised. National Financial Capability Study. Most older Americans are not at all confident about the efficacy of their efforts to save for retirement and in fact one-third of adults in their 50s have failed to develop any kind of retirement saving plan at all Lusardi 1999 2003. A look into their personal finances and financial behaviors. We Need People To Know The Abc Of Finance Facing Up To The Financial Literacy Crisis Financial Times.

And Susan Hyatt Professor of Economics at Dartmouth College where she taught for twenty years. Most older Americans are not at all confident about the efficacy of their efforts to save for retirement and in fact one-third of adults in their 50s have failed to develop any kind of retirement saving plan at all Lusardi 1999 2003. Annamaria Lusardi Pierre-Carl Michaud and Olivia S. As financial markets grow ever more complex and integrated households must make increasingly sophisticated and all-too-often. Annamaria Lusardi is an Italian-born economist and the Denit Trust Distinguished Scholar and Professor of Economics and Accountancy at The George Washington University School of Business where she also serves as the Academic Director of the Global Financial Literacy Excellence Center. Cintia Italy Netspar Italy Scientific Advisory Board.

Annamaria Lusardi and Olivia S. OUP Oxford Oct 27 2011 - Business Economics - 304 pages. Health and Retirement Study. Mitchell Oxford University Press Download PDF Financial Literacy and the Need for Financial Education. Starting at 10853 per book. Policy Work Annamaria Lusardi.

Introduction Households hold very different amounts of. Moreover she is the founder and academic director of GWSBs Global Financial Literacy Excellence Center. Annamaria Lusardi is University Professor of Economics and Accountancy at the George Washington University School of Business GWSB. And Susan Hyatt Professor of Economics at Dartmouth College where she taught for twenty years. Annamaria Lusardi and Olivia S. Pdf Financial Literacy And Retirement Preparedness Evidence And Implications For Financial Education.

This is a particular concern for female-headed households who face many lean years. Previously she was the Joel Z. Mitchell Oxford University Press Download PDF Financial Literacy and the Need for Financial Education. As financial markets grow ever more complex and integrated households must make increasingly sophisticated and all-too-often irreversible economic decisions. In fact the personal savings rate has been holding steady at zero for several years down from 8 percent in the mid-1980s. People In Economics Retirement Behaviorist In Finance Development Volume 0057 Issue 001 2020.

Mitchell NBER Working Paper No. Her interests focus on financial literacy and financial education. Google Scholar Lusardi. Annamaria Lusardi Pierre-Carl Michaud and Olivia S. And Susan Hyatt Professor of Economics at Dartmouth College where she taught for twenty years. Gw Expert S P Global Financial Literacy Survey Results Alarming Gw Today The George Washington University.

Overcoming the Saving Slump explores the many challenges facing workers in the transition from a traditional defined benefit pension system to one. Mitchell Oxford University Press Download PDF Financial Literacy and the Need for Financial Education. Mitchell mitchelowhartonupennedu is the International Foundation of Employee Benefit Plans Professor in the Department of Insurance and Risk Management the Wharton School at the University of Pennsylvania. Book Google Scholar Lusardi A de Bassa Scheresberg C and Avery M. Moreover she is the founder and academic director of GWSBs Global Financial Literacy Excellence Center. Sprechen Sie Mit Kindern Moglichst Oft Uber Geld Swiss Life Gruppe.