The adjusted book value method of valuation is most often used to assign value to distressed companies facing potential liquidation or companies that hold tangible assets. Formulae for when the debts book value N is not the same as its market value D. adjusted book value formula.

Adjusted Book Value Formula, How is adjusted book value calculated. Step 1 Calculate the value of the unlevered firm or project VU ie. This rule book Rule Book sets out the formulae definitions rules and conventions that BISL will implement to calculate the Rate Adjustments in line with the ISDA Consultations referenced above.

Book Value Definition Example Investing Answers Financial Statement Analysis Book Value Investing From sk.pinterest.com

Book Value Definition Example Investing Answers Financial Statement Analysis Book Value Investing From sk.pinterest.com

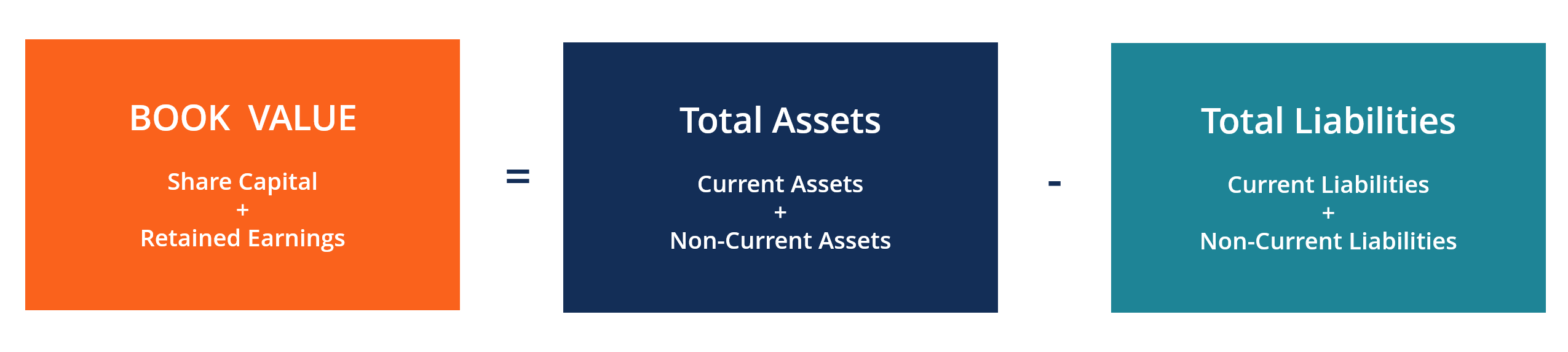

The adjusted book value method of corporate valuation begins with valuation of all the assets of the firm. The next step is to calculate the book value by subtracting liabilities from the total assets. According to the analyst and according to the company it will be calculated in one way or another.

The adjusted book value method of valuation is most often used to assign value to distressed companies facing potential liquidation or companies that hold tangible assets.

The adjusted book value method of corporate valuation begins with valuation of all the assets of the firm. Buildings are normally valued at replacement cost. Its value with all-equity financing. In computing adjusted book value such intangible items as goodwill patents and copyrights are often deducted from the net worth and assets such as equipment inventories and real estate are adjusted to fair market value. Book Value The value of an asset on the books of the Company before allowance for depreciation or amortization. The difference between the adjusted assets less the adjusted liabilities is the assumed market value of the stockholder equity.

Another Article :

The Rate Adjustment shall be a function of the value of the relevant Underlying Rates. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. Calculate the book value. Book value also known as adjusted cost base ACB is calculated by adding the total amount of contributions made by an investor into a mutual fund plus reinvested fund distributions minus any withdrawals. Calculate the market value of the assets. Book Value Vs Market Value How They Differ How They Help Investors.

The formula for calculating the adjusted book value is. This amount will equal the owners equity in the firm and likewise equals the book value of the firm. Its value with all-equity financing. Formula for adjusted present value considering the cost of leverage. The adjusted book value method of valuation is most often used to assign value to distressed companies facing potential liquidation or companies that hold tangible assets. Beginners With Little Background In Statistics And Econometrics Often Have A Hard Time Understanding The Benefits Of Interactive Learning Textbook Interactive.

Buildings are normally valued at replacement cost. Calculate the market value of the assets. Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. Calculate the book value. Book value of a. Numword Convert Numbers To Words With Free Excel Add In Excel Excel Macros Words.

This is the amount that the companys creditors and investors can expect to receive if the company is liquidated. Land is valued at its current market price. The simplified formulae as a leverage-induced reduction of the FCF. This rule book Rule Book sets out the formulae definitions rules and conventions that BISL will implement to calculate the Rate Adjustments in line with the ISDA Consultations referenced above. Book value also known as adjusted cost base ACB is calculated by adding the total amount of contributions made by an investor into a mutual fund plus reinvested fund distributions minus any withdrawals. Formula For Calculating Net Present Value Npv In Excel Excel Formula Calculator.

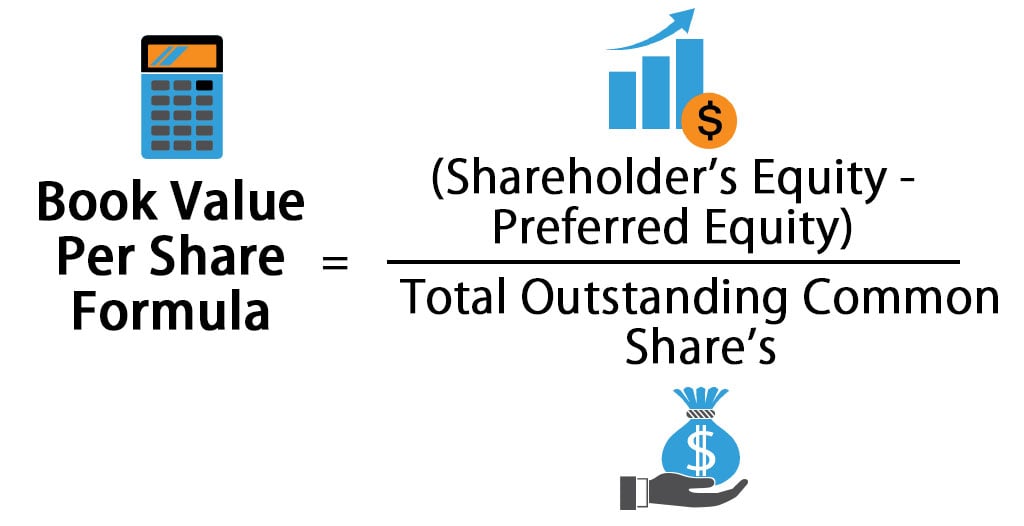

This rule book Rule Book sets out the formulae definitions rules and conventions that BISL will implement to calculate the Rate Adjustments in line with the ISDA Consultations referenced above. For instance if a company has assets of 100000 and liabilities of 20000 the book value. How Book Value of Assets Works. Adjusted book value adjusted asset - adjusted liability The word adjusted as used in this calculation can either increase or decrease. In this equation book value per share is calculated as follows. A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books.

Step 1 Calculate the value of the unlevered firm or project VU ie. Land is valued at its current market price. Fixed assets constitute substantial portion of the asset side of the balance sheet in capital intensive companies. Book value Assets Liabilities. According to the analyst and according to the company it will be calculated in one way or another. Book Value Per Share Formula Calculator Excel Template.

The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. Adjusted book value adjusted asset. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. Subtract assets from liabilities. How is adjusted book value calculated. How To Calculate Interest Compounding For Exponential Growth Accounting Principles Intrest Rate Exponential.

Calculate the market value of the assets. Calculate the market value of the assets. Adjusted Book Value Method - Valuation information Selling your corporation. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. Calculate the book value. Methods Of Depreciation Learn Accounting Method Fixed Asset.

The Adjusted Present Value for valuation The APV method to calculate the levered value VL of a firm or project consists of three steps. Adjusted book value adjusted asset. Subtract assets from liabilities. The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. In this equation book value per share is calculated as follows. Using Cie Lab To Adjust And Search Color Youtube Lab Values Cie Lab.

The simplified formulae as a leverage-induced reduction of the FCF. Home Adjusted Retail Book Value Adjusted Retail Book Value The ending retail book value corrected to reflect all stock shortages and stock overages. Book value is used from a tax perspective to determine if an investor is in a capital gain or loss position on a particular holding. For instance if a company has assets of 100000 and liabilities of 20000 the book value. It is the value that results after one or more than one asset or liability amounts change by way of adding deleting or changing in any way which makes the figures different from what shows in the financial statement. For More Information And Details Check This Www Linktr Ee Ronaldvanloon In 2021 Data Science Statistics Math Research Methods.

The calculation of book value for an asset is the original cost of the asset minus the accumulated depreciation where accumulated depreciation is the average annual depreciation multiplied by the age of the asset in years. Adjusted book value is always lower than the intrinsic value of the business. Unlevered cost of capital rU Risk-free rate beta Expected market return Risk-free rate. This rule book Rule Book sets out the formulae definitions rules and conventions that BISL will implement to calculate the Rate Adjustments in line with the ISDA Consultations referenced above. The downside of using. A Journal Entry Is The First Step Of The Accounting Or Book Keeping Process In This Step All The Accounting Transactions A Accounting Journal Entries Journal.

Adjusted book value adjusted asset. Calculate the market value of the assets. Adjusted book value adjusted asset - adjusted liability The word adjusted as used in this calculation can either increase or decrease. The formula for calculating the adjusted book value is. The adjusted book value method of corporate valuation begins with valuation of all the assets of the firm. Book Value Definition Importance And The Issue Of Intangibles.

Adjusted book value is always lower than the intrinsic value of the business. The adjusted book value method of valuation is most often used to assign value to distressed companies facing potential liquidation or companies that hold tangible assets. Theoretically book value represents the total amount a company is worth if all its assets are sold and all the liabilities are paid back. Home Adjusted Retail Book Value Adjusted Retail Book Value The ending retail book value corrected to reflect all stock shortages and stock overages. This rule book Rule Book sets out the formulae definitions rules and conventions that BISL will implement to calculate the Rate Adjustments in line with the ISDA Consultations referenced above. Using Apv A Better Tool For Valuing Operations Project Finance Cost Accounting Finance.

Fixed assets constitute substantial portion of the asset side of the balance sheet in capital intensive companies. Adjusted Net Worth Borrower shall at all times maintain Adjusted Net Worth of not less than 250000000. Buildings are normally valued at replacement cost. How Book Value of Assets Works. Adjusted book value adjusted asset - adjusted liability The word adjusted as used in this calculation can either increase or decrease. Business Valuation Veristrat Infographic Business Valuation Business Infographic.

The simplified formulae as a leverage-induced reduction of the FCF. Book value in finance also referred to as stockholders equity or liquidation value is calculated by subtracting liabilities from assets. Despite this we can provide a general formula as follows. Specifically book value concerns the total value of company assets minus the total value of company liabilities. Adjusted Net Worth Borrower shall at all times maintain Adjusted Net Worth of not less than 250000000. Fair Value Meaning Approaches Levels And More Business Valuation Learn Accounting Accounting Education.