In the Books of Lessee. Accounting Treatment of Finance Lease. accounting treatment of finance lease in the books of lessor.

Accounting Treatment Of Finance Lease In The Books Of Lessor, In the beginning of lease Lease Receivables Account Debit Fixed Asset Account Credit In the end of first year and subsequent years. Accounting Treatment In the books of Lessor Total value of the investment plus income receivable on it will be treated as receivables in the Balance sheet. The main driver between operating and finance leases for lessors under IFRS 16 is transfer of ownership.

Lkas 17 Orientation Objective Scope Definition Classification Of From slidetodoc.com

Lkas 17 Orientation Objective Scope Definition Classification Of From slidetodoc.com

The corresponding annual lease charge depreciation etc. The accounting is based on whether significant risks and rewards incidental to ownership of an underlying asset are transferred to the lessee in which case the lease is classified as a finance lease. Whereas the royalty which is paid on the basis of sales is debited to the Profit Loss Ac.

Recognises as receivables at amount equal to net investment.

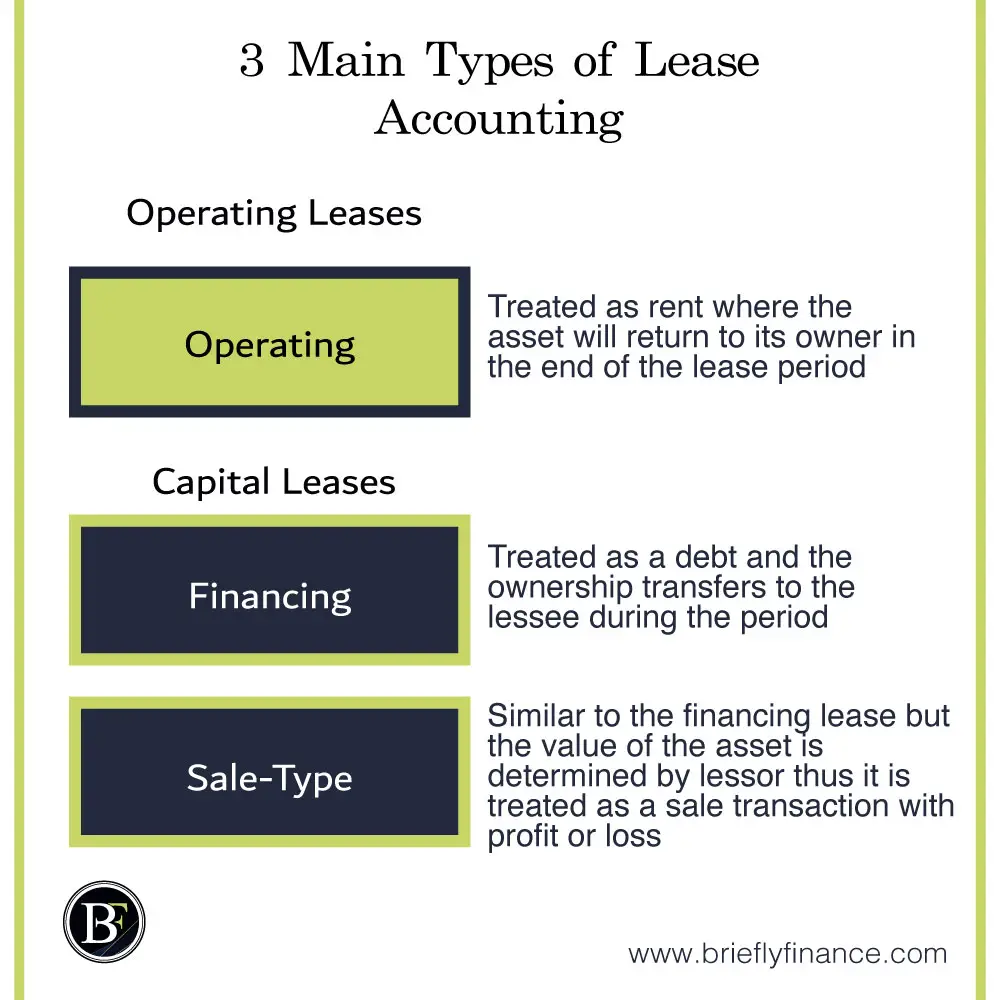

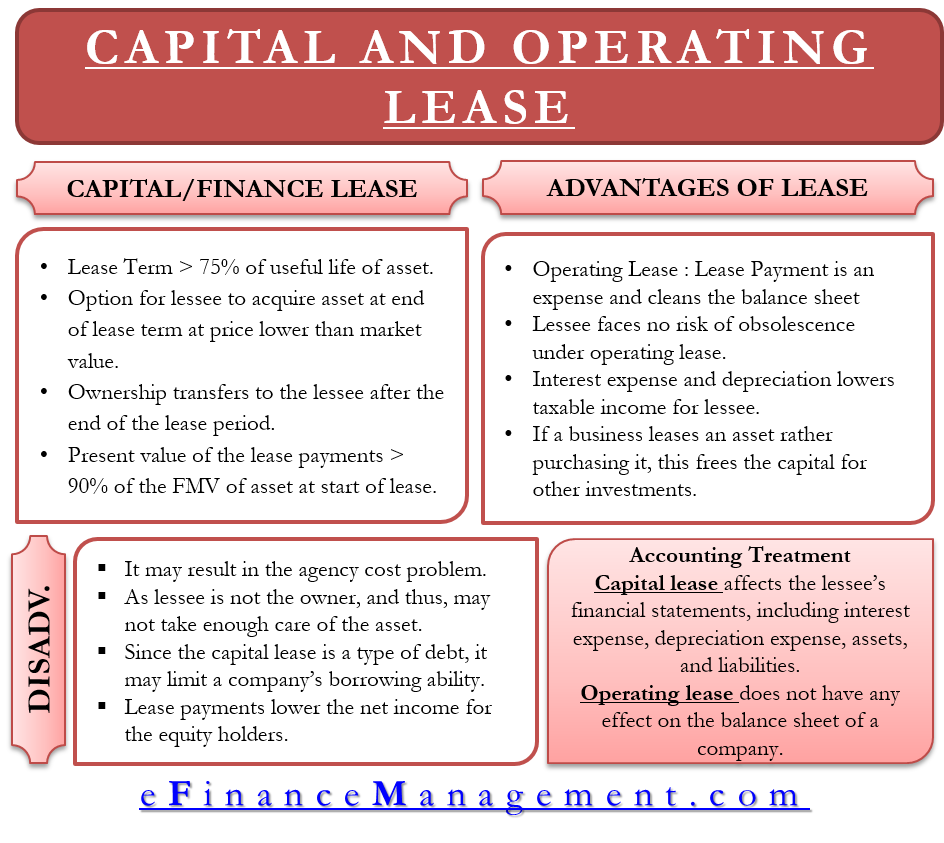

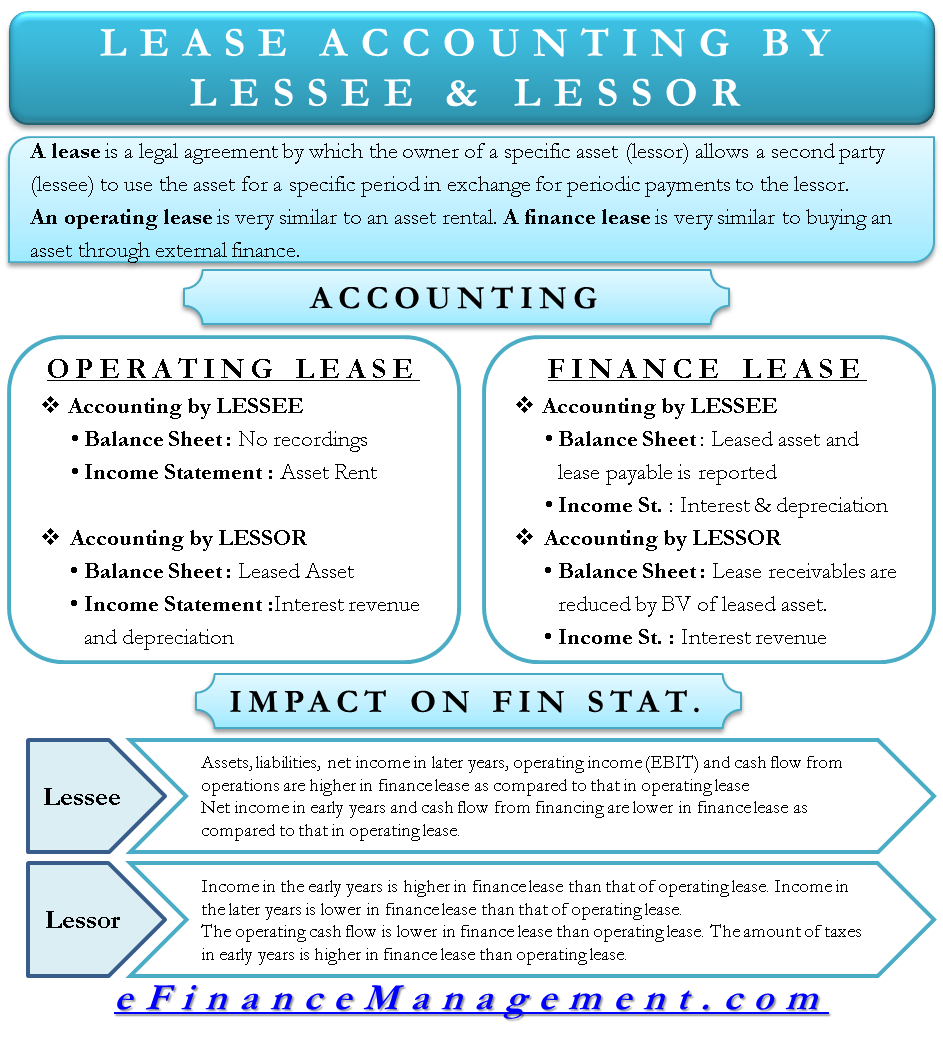

A finance lease also called capital lease in the US GAAP in which the risks and rewards. Lease accounting lessor financial lease treat as receivables operating lease treat as fixed asset and depreciation is to be charged lessee short tenure upto 12 months at the option of the lessee lease payments will be treated as expense long tenure recognised as right of use asset if lease transfers ownership or there is certainty of exercise. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Unlike in lessee accounting treatment the lessee for tax purposes does not recognize an asset but rather claims as rental expense the amount of rent paid or accrued including all expenses that under the terms of the agreement the lessee is. The main driver between operating and finance leases for lessors under IFRS 16 is transfer of ownership. Net Investment Present value of Gross Investment.

Another Article :

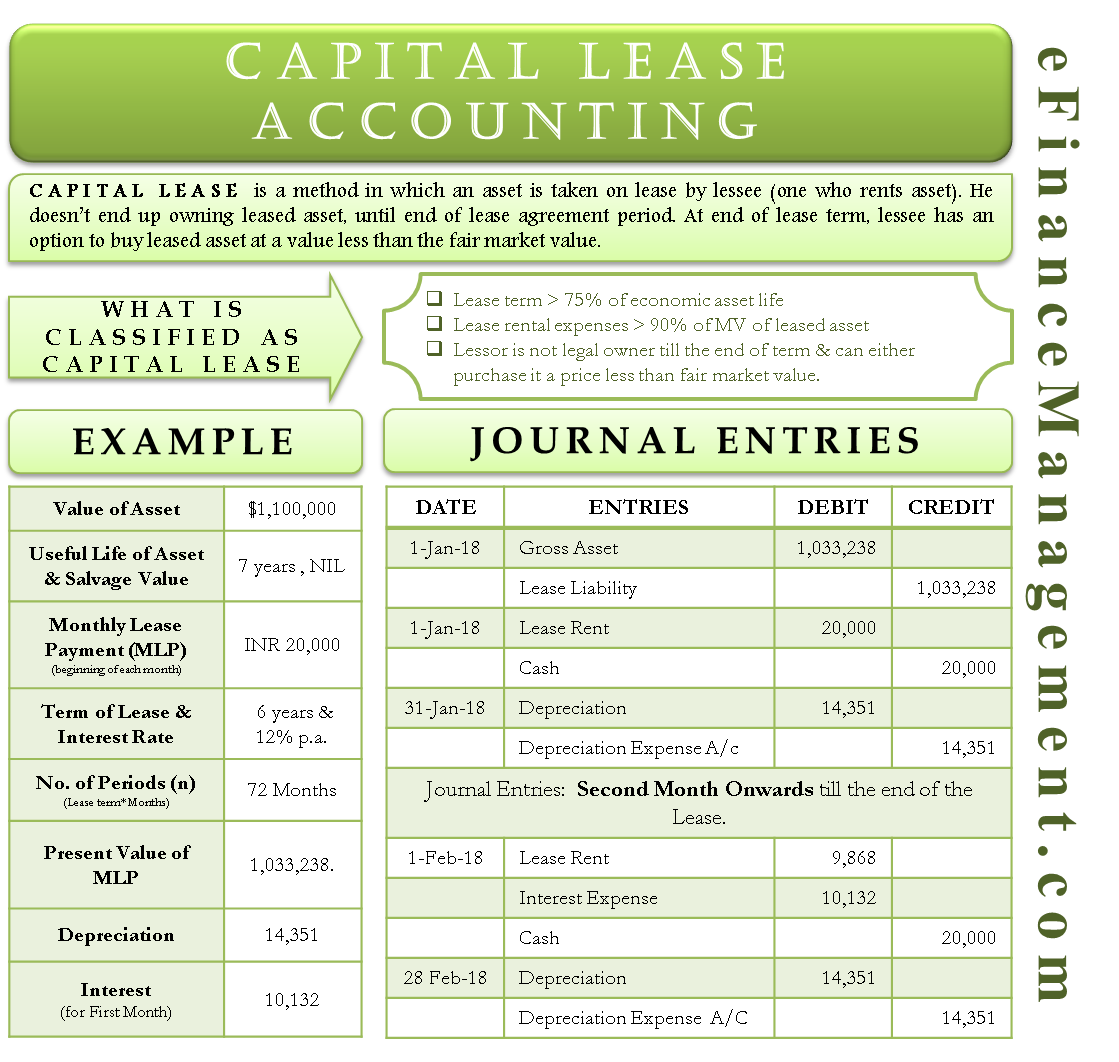

The lease receivable recognised by a lessor under a finance lease is a financial instrument and is subject to the derecognition and impairment provisions of IAS 39. For total amount of lease receivables. The lease receivable recognised by a lessor under a finance lease is a financial instrument and is subject to the derecognition and impairment provisions of IAS 39. Accounting for Finance Lease by Lessee. Finance lease in non-cancellable contract and also lessor is not responsible for any expenses and taxes of the leased asset. Capital Lease Accounting With Example And Journal Entries.

Unlike in lessee accounting treatment the lessee for tax purposes does not recognize an asset but rather claims as rental expense the amount of rent paid or accrued including all expenses that under the terms of the agreement the lessee is. A lease is either. Lessor accounting utilizes the opposite concept - the exact value of all future lease payments are initially recorded as a lease receivable. The finance lease is reported by the lessee as follows on different financial statements. Accounting Treatment of Finance Lease. Leases Accounting As 19.

The entries would therefore be the reverse of those made in the Lessees books. For a fuller explanation of journal. Accounting for Finance Lease by Lessee. In the Books of Lessee. Journal Entries in the Books of Lessor A When there is Capital Lease 1. Lkas 17 Orientation Objective Scope Definition Classification Of.

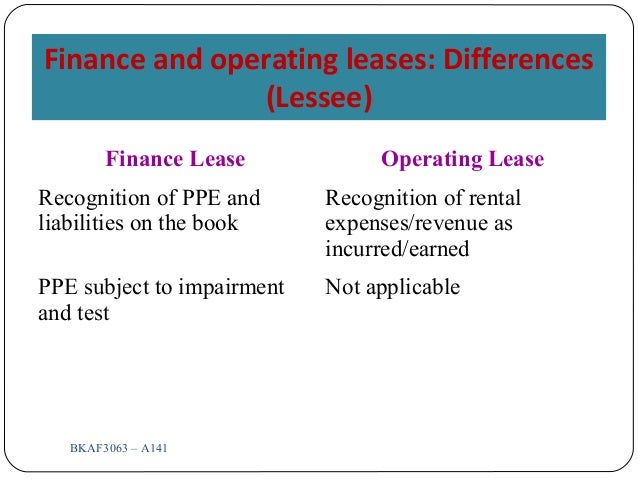

A finance lease also called capital lease in the US GAAP in which the risks and rewards. Both leased asset and lease payable liability is reported. The ongoing amortization of the right-of-use asset The ongoing amortization of the interest on the lease liability Any variable lease payments that are not included in the lease liability. Accounting Treatment of Finance Lease. Lessors recognise assets that are subject to finance leases in their balance sheet statement of financial position as a receivable a debtor at an amount that is equal to the net investment in the lease which is the gross investment in the lease but discounted at the interest rate implicit in the lease. Ias 17 Lease Finance Accounting Treatment Disclosure.

In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. A finance lease also called capital lease in the US GAAP in which the risks and rewards. Lessor accounting model. Accounting Treatment of Finance Lease. The lessor shall record the start of a lease by creating a lease receivable at its net investment in lease which is equal to the lease payments discounted at the rate of interest implicit in the lease. Operating Vs Capital Leases Lessee And Lessor Perspective.

Only finance leases are required to be capitalized on balance sheet. The Lessor is entitled to receive Royalty from the Lessee. The finance lease is reported by the lessee as follows on different financial statements. The accounting for an operating lease assumes that the lessor owns the leased asset and the lessee has obtained the use of the underlying asset only for a fixed period of time. This separation between the assets ownership lessor and control of the asset lessee is referred to as the agency cost of leasing. A Refresher On Accounting For Leases The Cpa Journal.

Based on this ownership and usage pattern we describe the accounting treatment of an operating lease by the lessee and lessor. The main driver between operating and finance leases for lessors under IFRS 16 is transfer of ownership. This separation between the assets ownership lessor and control of the asset lessee is referred to as the agency cost of leasing. In the Books of Lessee. Accounting Treatment of Leases. Journal Entries Of Lease Accounting Education.

For total amount of lease receivables. For a fuller explanation of journal. The accounting and reporting of different leases are as follows. This is an important concept in lease accounting. The ongoing amortization of the right-of-use asset The ongoing amortization of the interest on the lease liability Any variable lease payments that are not included in the lease liability. Leased Asset Types Accounting Treatment And More.

In the beginning of lease Lease Receivables Account Debit Fixed Asset Account Credit In the end of first year and subsequent years. Recognises as receivables at amount equal to net investment. In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Lease agreements where the lessor maintains ownership are operating leases. Lessor accounting utilizes the opposite concept - the exact value of all future lease payments are initially recorded as a lease receivable. Lease Accounting A Guide For Tech Companies Bdo Insights.

Lease agreements where the lessor maintains ownership are operating leases. The corresponding annual lease charge depreciation etc. Only finance leases are required to be capitalized on balance sheet. Accounting Treatment of Leases. For Receiving the amount of lease. Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap.

Record the assets as a non current asset in the lessees statement Present value of lease payments or Fair value whichever is lower. It is just like credit sale of fixed asset. B In the Books of Lessee. Lessor accounting finance leases. Recognises as receivables at amount equal to net investment. Topic 1 Accounting For Leases.

In the beginning of lease Lease Receivables Account Debit Fixed Asset Account Credit In the end of first year and subsequent years. 3 Lessor accounting 23 31 Lessor accounting model 23 32 Lease classification 24 33 Operating lease model 27 34 Finance lease model 28 35 Presentation and disclosure 29 4 Lease definition 31 41 Overview 31 42 Identified asset 32 43 Economic benefits from using the asset 38 44 Right to direct the use 40 5 Separating components 46. For example rent received is of 5000 Lease. The lessor shall record the start of a lease by creating a lease receivable at its net investment in lease which is equal to the lease payments discounted at the rate of interest implicit in the lease. The accounting and reporting of different leases are as follows. Accounting Entries For Operating Leases With Case Study Example Learn Accounting Online.

The entries would therefore be the reverse of those made in the Lessees books. A lease is either. Financial statements of lessor will appear as follows. Lease modifications are accounted for by the lessor as a new lease from the effective date of the modification considering any prepaid or accrued lease payments relating to the original lease as part of the lease payments for the new lease IFRS 1687. Operating Lease Accounting by Lessee. Lkas 17 Orientation Objective Scope Definition Classification Of.

Are calculated for the term of lease. The main driver between operating and finance leases for lessors under IFRS 16 is transfer of ownership. The leased assets are capitalized and included in Property plant and equipment and the corresponding liability to the lessor is included in Other liabilities. Lessors recognise assets that are subject to finance leases in their balance sheet statement of financial position as a receivable a debtor at an amount that is equal to the net investment in the lease which is the gross investment in the lease but discounted at the interest rate implicit in the lease. In addition the difference between the lease payments and the assets cost is recorded immediately as unearned interest revenue. Lessee Accounting For Governments An In Depth Look Journal Of Accountancy.

Disclosure Disclosure requirements for lessors are set out in paragraphs IFRS 1689-97. In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. A lessee uses the leased asset and makes regular payments to the lessor. Accounting Treatment of Finance Lease. Net Investment Present value of Gross Investment. Lessee Accounting For Governments An In Depth Look Journal Of Accountancy.